Table Of Content

- April 25: Rightmove Reports Record Average Prices Topping £360,000

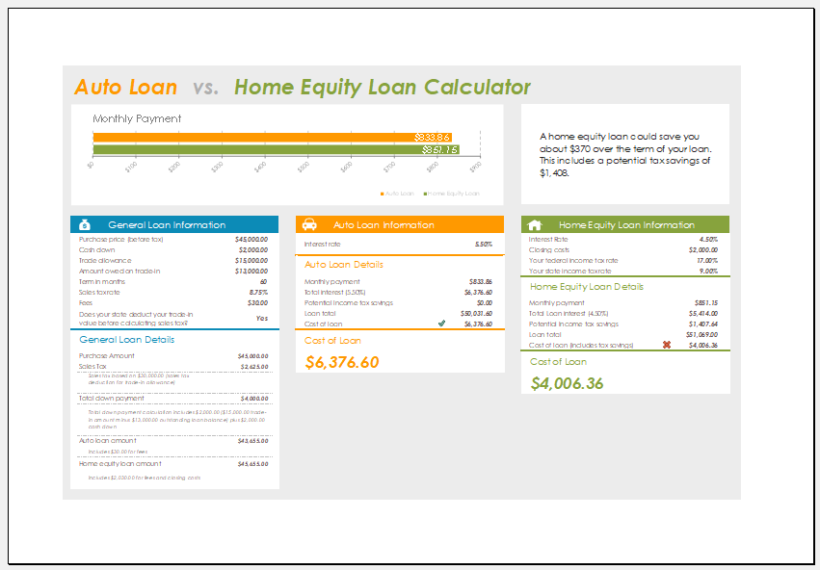

- Home equity loans and private mortgage insurance (PMI)

- What are the requirements to qualify for a home equity loan

- October: Rightmove – Asking Prices Up But Growth Set To Slow

- When Is A Home Equity Loan A Good Idea?

- September 2022: Stamp Duty Receipts Up 29% On Last Year – HMRC

But this was a slower decline than that recorded for Q2, when prices fell by 4.3%. “Pricing is higher than borrowers have grown used to over the years, meaning those buyers relying on mortgages are more price-sensitive on the back of ongoing affordability concerns. Nationwide’s chief economist Robert Gardner says the slight uptick in prices seen in October reflects the severe lack of supply of properties for sale. But he points out there is little sign of forced selling or distressed sellers, which would exert further downward pressure on prices.

April 25: Rightmove Reports Record Average Prices Topping £360,000

However, at 18% behind last year, agreed sales are consistent with more normal levels of market activity. Rises were recorded in all UK regions this month, with the exception of London and the North East which saw falls of 0.5% and 0.1% respectively. According to the society’s latest monthly House Price Index, prices rose by 0.5% from March to April following seven consecutive monthly falls. First-time buyers represented the largest buyer group in 2022, accounting for more than estimated 34% of sales, according to the report. But affordability constraints for those taking the first step on the ladder remain tough. The latest figures indicate a soft landing to the housing market according to Zoopla, with a major price correction remaining a ‘very low probability’.

Home equity loans and private mortgage insurance (PMI)

However, the March figure is the weakest rate of annual growth reported by Halifax since October 2019, and compares to 12.5% at its peak in June 2022. The number of sales being agreed in April suggests a healthier market than many expected, said Rightmove. Levels are just 1% under the pre-Covid figures for March 2019, and above those seen in September before they plummeted by 21% following the mini-Budget.

What are the requirements to qualify for a home equity loan

Surprisingly, affordability has improved the most in London where the price-to-earnings ratio will move to single digits for the first time in 11 years as house price growth continues to lag earnings growth. By contrast, in July and August last year, annual house price inflation was running at 11% and 10% respectively, according to the lender’s own figures. “It may also come as some relief to those looking to get onto the property ladder. Income growth has remained strong over recent months, which has seen the house price to income ratio for first-time buyers fall from a peak of 5.8 in June last year to now 5.1. The average asking price of properties coming onto the housing market rose by a marginal 0.4% in September after three months of falls, according to Rightmove, writes Jo Thornhill. “The housing market continues to show remarkable resilience considering the economic uncertainty.

The number of people in mortgage arrears has increased notably, according to figures from UK Finance, which represents the banking and finance sector, writes Mark Hooson. But despite falls in prices, Righmove says key indicators point to better market activity than predicted in 2023. Vendors are accepting 5.5% off the asking price, on average, to agree a sale, which equates to £18,000 in cash terms. London prices are down marginally year on year by 0.1%, with a 0.9% drop in December. It suggests today’s market is being driven by ‘mid-market’ second-steppers (those trading up from their first property) with demand for this group up 9% on last year. Overall buyer demand is up by 6% after some movers paused to wait for improved conditions.

Home loan-to-value ratio vs. home equity: what's the difference? - Mozo.com.au

Home loan-to-value ratio vs. home equity: what's the difference?.

Posted: Thu, 07 Dec 2023 08:00:00 GMT [source]

When Is A Home Equity Loan A Good Idea?

The equity from your home or investment property can be used as a deposit on a second property, while your current property becomes a security on the new debt. Keep in mind that you'll need more than the deposit - stamp duty and legal fees will have to be factored in. If you can afford to add a few extra dollars to your regular repayments, you can also reduce the term of your loan and save the amount of interest you pay. You can either do this by making additional repayments, paying both principal interest, or even adding an offset sub-account to your home loan. To use our home equity calculator, simply fill in a few details like the estimated value of your property and the outstanding balance of your home loan. Keep in mind that your estimated usable equity is based on 80% of the estimated value of the property and subject to other factors such as fees and other costs which will be different for each lender.

Indeed, home prices saw global price increases through 2021 due to the stay-at-home policy and people looking for bigger homes to fit their work, schooling, and life. Also, the growing work-from-home policies adopted by companies that might extend beyond COVID have incentivized many families to move to the suburbs from the city. All in all we are at a historic junction for the pandemic and its impact on homes and the future of it is yet to be seen.

November: Annual Price Inflation Tumbles As First Time Buyers Struggle – Halifax

The bank says the average UK property price stands at £262,954, which is a record high. Demand has been fuelled in recent months by changes to stamp duty rules, including the ending of the tax holiday in Wales and the tapering of relief in England. Halifax said the latest monthly rate of growth is the largest since February 2007.

How to use your home equity to get a cheaper mortgage Home loans - Mozo.com.au

How to use your home equity to get a cheaper mortgage Home loans.

Posted: Fri, 12 Jan 2024 08:00:00 GMT [source]

House prices in the South West have grown 14.7% year-on-year, closely followed by East Anglia, where the average price has risen by 14.2% in the last 12 months. South West England has overtaken Wales as the UK region with the strongest annual price growth. The figures mark the highest annual increase the property website has recorded in 16 years. But Rightmove also acknowledged that several factors point to activity in the market continuing to cool and that the impact of interest rate rises would filter through to the market over the remainder of 2022.

The figure was 219% higher compared with the same month in 2020 when the effects of the pandemic impacted heavily on the property market. Last month’s figure was also 74% higher than the one recorded for May 2021, according to HMRC. Elsewhere around the regions, London recorded the most sluggish rise in annual growth returning a figure of 6.3% over the same period. Regionally, the North East has enjoyed the strongest house price growth over the past year, with a figure of 10.8% to July.

Our advertisers do not compensate us for favorable reviews or recommendations. Our site has comprehensive free listings and information for a variety of financial services from mortgages to banking to insurance, but we don’t include every product in the marketplace. In addition, though we strive to make our listings as current as possible, check with the individual providers for the latest information. But the increased value might leave you wondering how to get equity out of your home. The good news is that you have several options, including second mortgages and cash-out refinancing, which we explore in detail. An FHA loan is government-backed, insured by the Federal Housing Administration.

The drop in the annual figure, the eighth consecutive fall recorded this year by the building society, wipes an average £14,600 off the value of a typical UK home which is now worth £259,152. Despite the sluggish market, the first-time-buyer sector remains relatively resilient, fuelled by record high costs in the rental market pushing more tenants onto the housing ladder. “Affordability remains stretched for those relying on mortgages to fund their purchases but lenders continue to reduce their pricing which over time will help ease the situation. Last week the average rate on five-year fixed mortgages fell to below 6% for the first time since early July, according to Moneyfacts.

Rocketing house price inflation since the start of the pandemic in 2020 could be showing the first signs easing. More than one-in-20 homes had its asking price slashed in April by an average of 9% or £22,500 – the widest discount margin seen for the last 18 months – while properties for sale are remaining on the market for longer. The South West of England also recorded a strong rate of annual growth at 14.5%, with an average property costing £305,173. The biggest annual rises in May were recorded in Northern Ireland where the value of an average property increased by 15.2% to a current £185,386.

No comments:

Post a Comment